What if you could run a profitable business while keeping your job? You could have the best of both worlds — a stable income and short-term security from the job, and a second income and long-term security from the business. Once the business is big enough, you might be able to quit your job and semi-retire, and spend more time on activities that you love like your family or traveling around the world. You could also expand to more locations, cash out and sell the business, or just hold on it for the extra cashflow!

I’m not making this up, because I’ve done it! I ran my first business (a therapeutic massage franchise) in around 10 hours per week. I spent the rest of my time traveling, and started a new gig as an Area Director for the massage brand. I only went in to my shop about twice a week, when I was in town, and that was often to get a massage! After five years, I sold the business for a profit. Now I’m semi-retired and help other people go into business.

So, how can this be done? The easiest solution is to buy a semi-absentee franchise, which is basically a business-in-a-box that’s designed for this kind of operation.

Semi-Absentee Ownership

Semi-absentee is a model of business ownership where the owner works on the business, not in the business. Typically you hire a manager to run the day-to-day operations, and you spend your time focusing on the bigger picture aspects of the business.

I didn’t give massage when I ran the massage business. I hired massage therapists for that, and receptionists for scheduling appointments and customer service. Then I had a manager to take care of the employees, operations, and customer issues. The franchise provided many business systems, training, and operations support. My job was to take care of financing, marketing, and business strategy. I worked part-time, on my own schedule, and from home most of the time.

Here’s an example of the roles that you and the manager could take, though you can customize this however you want.

| Owner’s Role | Manager’s Role |

Invest in business

Manage the manager

Manage the finances

Decide on marketing & promotions

Design strategy to grow business | Day-to-day operations

Hire & manage employees

Handle customer issues

Implement marketing & promotions

Implement business systems |

However, semi-absentee is more than just an investment. Any business takes work, and you need to keep the business going in the right direction. You should expect to spend at least 10-20 hours per week on the business, though you may be able to decide when and where those hours are. You should also expect to spend more time at the beginning to get the business up and running, though a franchise can help with that.

Why a Franchise?

If you start a business from scratch, there is a huge learning curve and long time to build out the systems you need. You have to make every decision yourself, and it’s easy to make a mistake and go down the wrong path. Only about two thirds of businesses survive the first two years, and the failure rate is even higher for restaurants and tech startups.

With a franchise, you get a proven business model and a lot of support, which helps you get started faster. Franchises also have a higher success rate. FranNet, the company I work with, found that 91.2% of the franchises that they placed were still open after two years. That’s much better odds than starting on your own!

While every franchise is different, you typically get the following:

- An existing brand

- A business model that’s been tested and refined in other locations

- Marketing support to bring in customers faster

- Training on how to open and run your business

- Ongoing operations support

- Business systems such as software and brand trade secrets

- Network of other owners

- A franchisor who has a financial interest in your success

Furthermore, there are franchises that are specifically designed for semi-absentee ownership. They are built so that the owner can hire a manager for the day-to-day operations, and the franchise may even provide training and support directly to the manager. These are in many industries, including fitness, personal care, cleaning, pet services, retail stores, automotive, B2B, and many others.

The other great thing about franchises is that you can do a lot of research before you get started. You can find out things like the business model, expected startup costs, ongoing fees, training and support, and the franchise contract — all before you decide which franchise to work with.

What’s the Catch? Investment Level

Any business is an investment in both money and time. Semi-absentee businesses are typically a higher investment, because you need to pay a manager. However, they also scale better, because you can run multiple locations because you don’t have to be there every day. Once you have learned how to do one, it’s easy to replicate.

How much is the investment? That varies greatly from business to business, and there’s not a direct correlation between investment and return (but neither is a business a better bargain because it seems “cheap”). Some service franchises can be started for less than $100k, and opening a McDonald’s costs $1-2.2 million!

The good news is that because franchises have already opened many locations, each one can tell you the expected investment. The other good news is that, like a house, it’s easy to get a loan so that you only have to invest around 30% of your own money. In fact, it’s easier to get a loan for a franchise than starting on your own, because the franchise brand already has a history of success.

Getting Started in Business Exploration

There are over 3,600 franchise concepts out there in 90+ industries, and you need to find the right one for you. You can search the internet and do your own research, but much of the information you need is hidden, and the franchises that you’ve heard of may have already sold all the good territories.

Would you buy a house without a real estate agent? Like a realtor, a franchise consultant can help you identify which franchises match your goals and work style. They can help you through the process of talking with each franchisor, to understand their business model and decide if it’s right for you. Best of all, there’s typically no cost to you, and no obligation if you decide that business ownership isn’t for you.

I work with FranNet, whose franchise consultants have been helping people go into business for over 30 years. I can work with you to understand your needs, recommend potential franchises, and help walk you through the process. As I mentioned, there’s no cost and no obligation, and I’m available for questions anytime.

Here’s an outline of our process:

- Fill out a Personal Franchise Assessment, which looks at your values, motivation, work style, and investment tolerance.

- We’ll meet 1-1 and build out your personal business model, which we use to identify what kind of business you would want to build.

- We’ll identify some potential franchises that match your business model, and you can decide which ones to talk with.

- You’ll speak with the franchisor, and they will give you information about their business, including the Franchise Disclosure Document which includes estimated startup costs, financials, and the franchise contract.

- If you like a franchise, you’ll get to speak with existing franchise owners and ask them questions about what it’s like to own the business. In some cases, there may even be local owners who you can speak with to learn about the local market.

- If a franchise seems promising, you’ll likely have an opportunity to go meet the executive team and make a final decision whether to go forward.

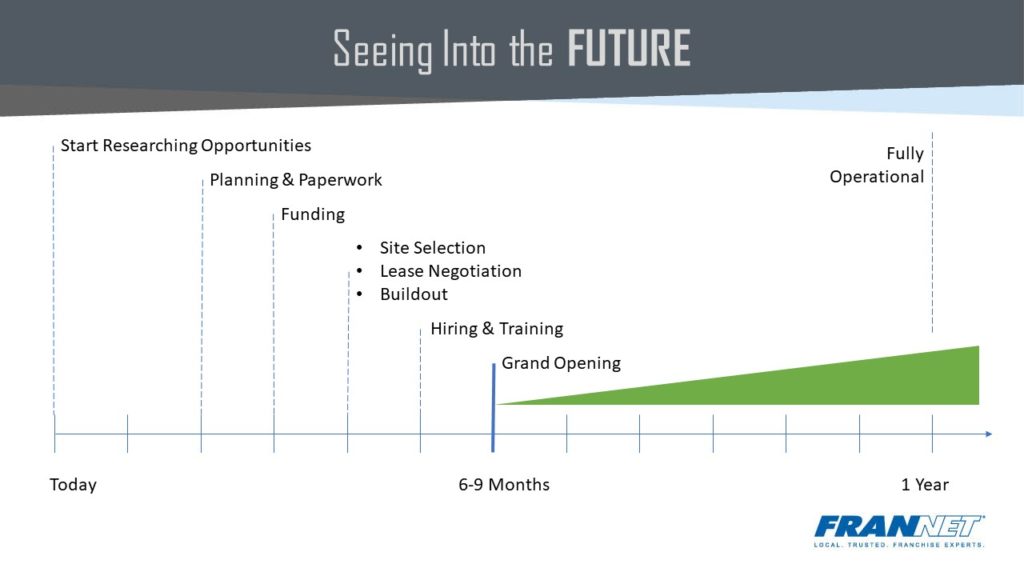

- Open the business! Every good franchise has a process to help you get your doors open quickly.

If this sounds good to you, please reach out to me to get started.

Having a Business / Work / Life Balance

Here are a few tips for juggling a semi-absentee business, a job, and still having time for a life.

- Follow the system. Franchises have developed many business systems and tested them across many locations. Yet some franchisees get obsessed doing things their own way, and focus on the wrong things. Especially as a semi-absentee owner, it’s better to follow the system and get it 80% right, than to focus on the other 20% and get 80% wrong.

- Hire, delegate, and trust. Nobody is going to do things as well as you would, but it’s important to delegate work and let them make mistakes. One of the first things I did was give my manager a credit card (with a spending limit), so that I didn’t have to be involved with every purchase. Give them direction and motivation, and let them do their jobs.

- Control your schedule. Many business owners become workaholics, as there is always more that you could work on. While my business was open 11 hours a day for 7 days a week, I mostly worked from home, took weekends off, didn’t work past 8pm, and only went in a couple of times a week (when I was in town). I had to make it a discipline NOT to work too hard, so that I didn’t burn out.

- Learn as you go. I knew little about running a business before I bought my first franchise, but I quickly grew it to be the biggest location in California and the #1 business on Yelp in my city. I learned from the franchisor, local business seminars, blogs (like this one), books, and free audio books from the library.

Ready to get started? You can jump right in with the Personal Franchise Assessment or reach out to me and we can chat about your goals and questions.

“Do something today that your future self will thank you for.”

Sean Patrick Flanery